|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding How to Refinance Seller Financed Mortgage for Better TermsRefinancing a seller financed mortgage can provide an opportunity to secure better interest rates and terms. This guide explores the essential aspects of refinancing this unique type of loan. What is a Seller Financed Mortgage?A seller financed mortgage occurs when the seller of a property offers the buyer a loan to purchase the home. This type of financing can be beneficial when traditional financing options are not available or desirable. Benefits of Seller Financing

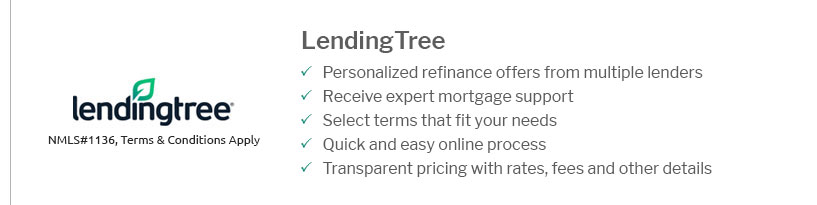

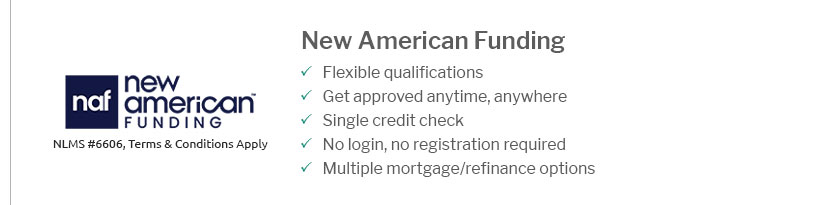

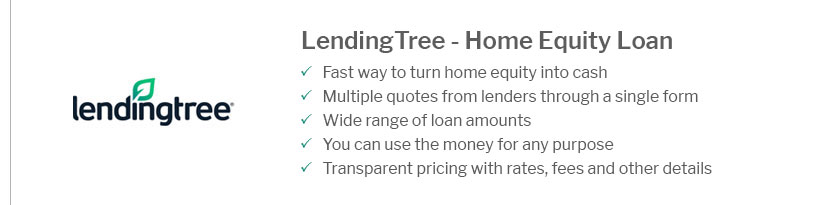

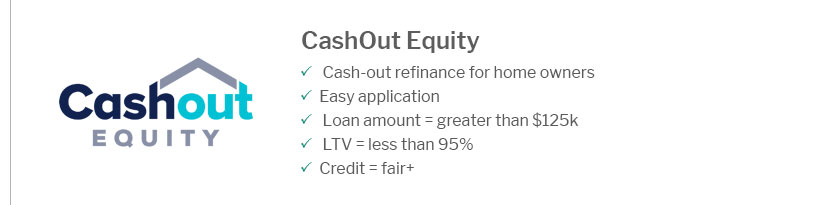

Reasons to RefinanceRefinancing a seller financed mortgage can help improve financial stability. Here are some reasons why homeowners choose to refinance: Lower Interest RatesOne of the primary reasons to refinance is to secure a lower interest rate, which can reduce monthly payments and save money over the loan term. Accessing Better Loan TermsRefinancing might allow borrowers to obtain more favorable terms, such as an extended repayment period or a fixed interest rate. For more information on refinancing options, visit home refinance companies to explore various solutions. Steps to Refinance

Considerations Before RefinancingIt's essential to weigh the costs and benefits of refinancing. Consider potential fees and ensure that the savings outweigh the expenses involved. For guidance on the refinancing process, check out how to refinance my house for a detailed walkthrough. Frequently Asked QuestionsCan I refinance a seller financed mortgage with a traditional lender?Yes, it's possible to refinance a seller financed mortgage with a traditional lender. This can be beneficial if the borrower qualifies for better interest rates and terms. What are the typical costs associated with refinancing?Refinancing costs may include appraisal fees, origination fees, and closing costs. It's crucial to compare these costs against the potential savings. How do I know if refinancing is the right choice?Consider your financial goals, current interest rates, and loan terms. Consulting with a financial advisor can also provide personalized advice. https://refi.com/refinancing-seller-financed-mortgage/

After the borrower has accumulated some equity in their home by making payments on the seller-financed loan, they can use a lender to ... https://themortgagereports.com/21743/owner-financing-mortgage-refinance-rates

Most of the time, owner financing isn't a permanent financing arrangement. At some point, the borrower will need to refinance into a traditional home loan. https://www.biggerpockets.com/forums/50/topics/1016459-seller-financing-refinance

The straightforward answer to your question is yes, it is possible to refinance the property into a conventional loan with a bank. There are a ...

|

|---|